Medicare has a variety of plans and parts within plans, each with its own pros and cons. Understanding some basic features will help you decide how to maximize your healthcare dollars and choices. You should review your choice periodically, especially as elements of the Inflation Reduction Act of 2022 change prescription medication and vaccine policies. Coverage can also change from year to year..

There are three basic types of plans:

- Original Medicare

- Medicare Advantage

- Medigap

Original Medicare

Medicare is a government health insurance plan for people 65 and older. Original Medicare, sometimes called traditional Medicare, comes in several parts. Each part covers different things and has various associated costs.

Most people do not pay for Part A as it was deducted from their taxes paid while working. It is primarily for hospital visits and nursing care. However, there are many fees associated with being in a hospital that Medicare does not cover, which you still might have to pay out of pocket.

Part B requires monthly premiums, which can be deducted from your social security. You can elect to enroll in part B through Original Medicare. It covers a portion of doctors’ visits, durable medical goods, and more.

Part D covers the cost of many prescription medications. You can add it to Original Medicare or purchase it as part of a Medicare Advantage plan.

Medicare Advantage

Medicare Advantage is offered through private insurance companies that Medicare approves. Most plans include Parts A, B, and D of Original Medicare with some variations from the original. There are a wide variety of Medicare Advantage plans, including Preferred Provider Organizations (PPO) or Health Maintenance Organizations (HMO). PPOs tend to have higher premiums and offer more choices than HMOs. Medicare Advantage HMOs and PPOs often have higher premiums than traditional Medicare because they usually cover more expenses, including prescription drug costs, vision, hearing, and dental.

However, the overall costs, premiums, plus out-of-pocket expenses for Advantage plans can be lower than Original Medicare because the private insurers manage patient care and limit choices. They assemble networks of hospitals and physicians to control their costs and reduce their customer’s premiums. They also restrict access to certain providers and increase the cost of care obtained out-of-network.

Traditional Medicare allows people to seek care from any provider participating in Medicare, which includes virtually all hospitals and physicians.

Medigap

Medigap is a co-insurance or supplement to Original Medicare. You can enroll when you first enroll in Part B. It is also available through Medicaid, a union, or a former employer when you qualify for both programs. You can’t have both Medicare Advantage and Medigap plans. Medigap helps cover expenses that Original Medicare does not cover, such as co-pays and deductibles. Due to the enrollment restrictions, you should strongly consider Medigap when you first become eligible.

The Right Choice for You

With all the different plans, parts, choices, and restrictions, it is crucial to consider your priorities for care. Limited access to doctors and hospitals may become important if you need specialized medical care, such as cancer treatment. Before enrolling, consider what specialty hospitals are included in Advantage plans. Likewise, Advantage plans can make it difficult to see a specialist for ongoing and chronic conditions due to limitations in long-term care services. An estate planning lawyer or elder law attorney can help address long-term care planning and the potential to qualify for Medicaid when necessary.

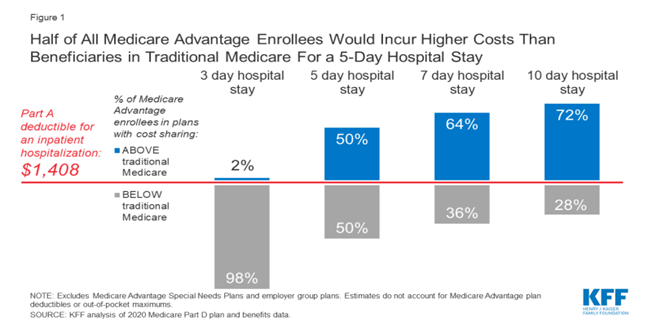

The Kaiser Family Foundation has put together a cost analysis to help you determine when Medicare Advantage would save you money. As you can see, the longer you stay in the hospital, the less advantageous an Advantage plan becomes.

Consumer Reports notes that the JAMA reported that seniors on Advantage plans often get more preventive care than those on traditional Medicare plans. JAMA published a comprehensive paper about how Medicare plan choice affects spending and discovered that Medicare Advantage enrollees usually spend less.

Consumer Reports notes that the JAMA reported that seniors on Advantage plans often get more preventive care than those on traditional Medicare plans. JAMA published a comprehensive paper about how Medicare plan choice affects spending and discovered that Medicare Advantage enrollees usually spend less.

A Guide in Choices after 65

Enrolling in the right Medicare coverage is one of many decisions that will affect your quality of life in your senior years. We are here to help you navigate a wide variety of choices. If you would like to discuss your situation, please don’t hesitate to reach out. Contact our office at (718) 979-7477.