Your social security benefits may be lowered by the Windfall Elimination Provision (WEP) if your pension plan did not pay social security payroll taxes. How can you know if this is your situation? Your social security statement does not reflect any reduction in benefits because of the WEP. The SSA will wait until you file to collect benefits to tell you what your reduction is in the event you qualify for both social security and a non-covered pension. Without the ability to accurately calculate your social security benefits in advance, your retirement planning becomes challenging. However, you do not have to wait until you file for Social Security to understand if a reduction in benefits will apply to you.

So what are the mechanics of the WEP? The Social Security Amendments of 1983 created the WEP to prevent gaming the system by “double-dipping.” Double-dipping occurs when a retired worker receiving a pension from a job that did not pay social security payroll taxes additionally gets a social security benefits check. The WEP provision began reducing social security benefits for these workers who receive a pension from that job which did not pay into the system.

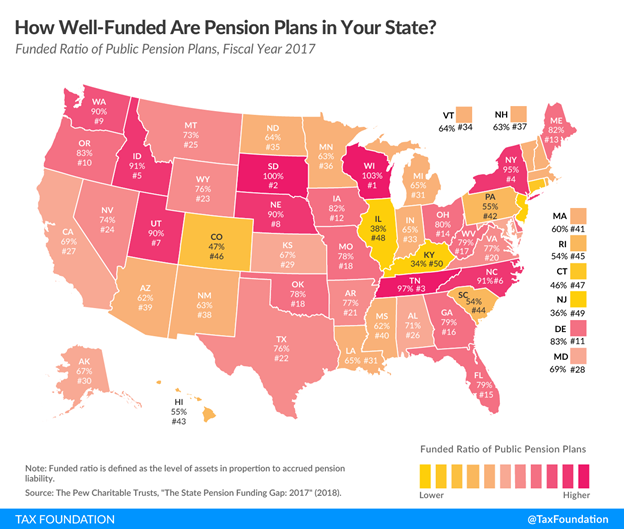

This reduction of benefits is most common among teachers and other public sector workers such as police and firefighters, state, county, and local employees, as well as non-profit organizations or if you were employed by another country. At the start, social security did not cover any public sector employees because states maintained pension funds. Over the years, however, many states dropped their pension funds and entered into the SSA coverage agreements, and the solvency of each state’s fund varies.

If public sector employment applies to your retirement, there is a rule that the maximum social security reduction can never be larger than one-half of your pension. The impact of the WEP starts to diminish if you have more than 20 years of substantial covered earnings. The WEP does not apply to your benefits at all after 30 years of substantial covered earnings.

A person with a mixture of both private and public sector employment generally has a smaller percentage of their income applied to their average indexed monthly earnings. Many Americans are choosing to work past full retirement age, and if you have a mixture of public and private employment, search for a new job where you can work an additional ten or so years to offset the WEP reduction.

The SSA has not made understanding the calculation process simple. There is one set of rules that calculate your baseline retirement benefit payout, the second set of rules defining how that number will change depending on the age you choose to retire, and even more rules to cover special situations like the WEP. Factor in your state’s pension solvency situation (with the help of SSA coverage agreements), and you can see how retirement planning is becoming very complex. It is advisable to find a financial planner to sort out your pension and social security benefits position accurately.

Whether or not you find the Windfall Elimination Provision fair is usually based on how it affects your financial position. Both Democrat and Republican lawmakers are looking at ways to amend the WEP formula that “some feel unfairly penalizes many public employees,” says Representative Richard Neal (D-Mass). There are separate bills currently under review to address this problem of fairness. Some policymakers are advocating that all public sector workers pay into the social security payroll tax. While this would be a simple solution going forward, it does not address the concerns of public sector employees who are going to be WEP affected.

Fixing the issues that face social security benefits is complicated. Congress is currently looking at making changes to the Windfall Elimination Provision to address public sector worker and constituent concerns. The percentages of Americans employed by federal, state, or local government ranges from 10 to 25 percent depending on the state in which you live and that is not taking into account non-profit or foreign country employment. Because policymakers can change the social security benefits calculation formula, your retirement planning is a dynamic problem to solve. The WEP is a special situation rule calculation that can affect your social security benefit and is under scrutiny for potential revision. Know your employment history fully as it relates to social security rules before retiring.

If you are retired or thinking about retiring, now is the time to update your estate plan. It is important that your medical and financial needs are addressed in your plan, and that you name qualified people to help out if needed. We would be happy to help you determine whether changes should be made. If you would like to discuss your particular situation, please don’t hesitate to reach out. Please contact our office at (718) 979-7477.